This post may contain affiliate links.We may earn little commission or products from the companies mentioned in this post.

Whether you just landed your first big job or have been working for a while now. It is never too late to start making proper plans for your money. Money is not the easiest thing to manage. However, setting goals keeps you focused and on track. Every financial goal is good at least you are changing your money mindset. However, there are reasonable financial goals that will help you now and years later into the future.

Here are 20 good financial goals to set not only in your twenties but the moment you start earning an income.

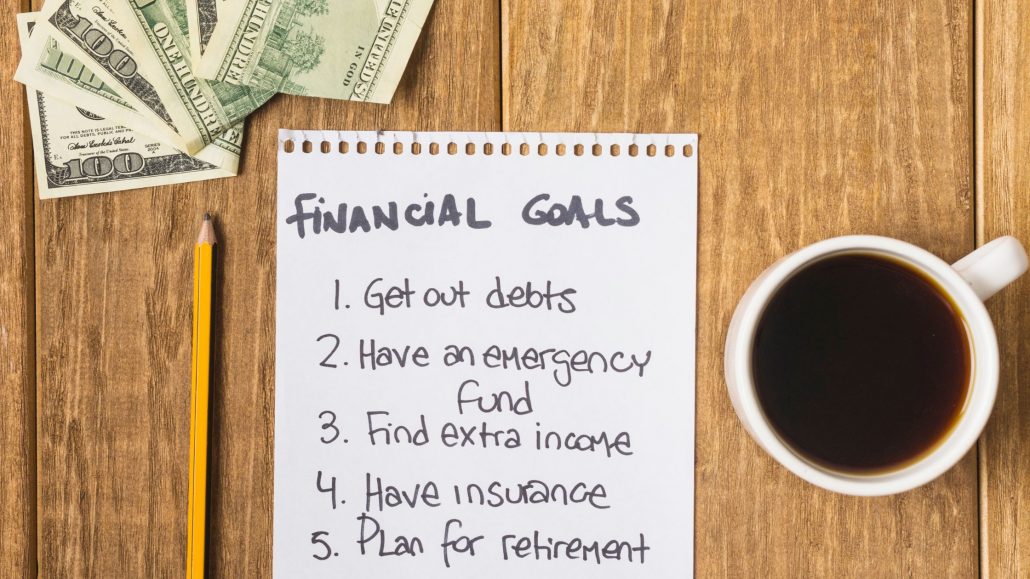

1. Building an emergency fund to cover unexpected expenses.

An emergency fund is an essential part of any financial plan as it provides a safety net in case of unexpected expenses or income loss. Here are the steps to build an emergency fund:

- Determine your emergency fund target: A good rule of thumb is to aim for three to six months’ worth of living expenses. Calculate your monthly expenses, including rent/mortgage payments, utilities, food, transportation, and any other regular bills.

- Open a separate savings account: Open a separate savings account specifically for your emergency fund. This will make it easier to track your progress and avoid dipping into the funds for non-emergency expenses.

- Set up automatic contributions: Set up automatic contributions to your emergency fund savings account each month. This way, you won’t have to remember to manually transfer money, and you can build up your emergency fund gradually over time.

- Cut expenses: Look for ways to reduce your expenses so that you can put more money toward your emergency fund. Consider cutting back on dining out, subscription services, or other non-essential spending.

- Increase income: Look for ways to increase your income, such as picking up a side job or selling unwanted items. This extra income can go directly into your emergency fund.

- Use windfalls: If you receive a windfall, such as a tax refund or bonus, consider putting some or all of it into your emergency fund.

- Keep it separate: Once you have built up your emergency fund, make sure to keep it separate from your other accounts. This will help ensure that you only use the funds for emergencies and not for everyday expenses.

Remember, building an emergency fund is a long-term process, so it’s important to stay committed and consistent in your savings efforts.

2. Paying off high-interest debt, such as credit card debt.

Paying off high-interest debt should be a priority for anyone who is carrying balances on credit cards, personal loans, or other high-interest loans. Here are some steps you can take to pay off high-interest debt:

- Organize your debts: Make a list of all your debts, including the balance, interest rate, and minimum monthly payment.

- Prioritize high-interest debt: Focus on paying off the debt with the highest interest rate first. This will save you the most money in interest charges over time.

- Make extra payments: Pay more than the minimum monthly payment whenever possible. This will help you pay off the debt faster and reduce the amount of interest you pay over time.

- Consider a balance transfer: If you have high-interest credit card debt, consider transferring the balance to a credit card with a lower interest rate. Just be sure to read the fine print and understand any fees associated with the balance transfer.

- Avoid taking on more debt: While you’re paying off your high-interest debt, avoid taking on more debt. This will only make it harder to pay off your existing debt and could lead to a cycle of debt that is difficult to break.

Paying off high-interest debt can take time and effort, but it is an important step toward achieving financial stability and reducing financial stress. By making a plan and staying committed to your debt repayment goals, you can become debt-free and on your way to achieving your other financial goals.

3. Saving for a down payment on a home.

Saving for a down payment on a house can seem like a daunting task, but with some careful planning and dedication, it is achievable. Here are some steps to help you save for a down payment on a house:

- Determine your down payment goal: The amount of money you need for a down payment will depend on the cost of the home and the down payment percentage required by your lender. As a general rule of thumb, aim to save at least 20% of the home’s purchase price for your down payment to avoid private mortgage insurance (PMI) charges.

- Create a budget: Create a budget to track your income and expenses. Look for areas where you can cut back on spending to increase your savings rate.

- Automate savings: Set up automatic transfers from your checking account to dedicated savings account each month. This way, you can build up your savings gradually without having to think about it.

- Consider a high-yield savings account: Look for a high-yield savings account that pays a higher interest rate than a traditional savings account. This can help your savings grow more quickly.

- Reduce debt: If you have high-interest debt, such as credit card balances or personal loans, focus on paying off this debt first. This will free up more money to put toward your down payment savings.

- Look for additional sources of income: Consider taking on a side job or selling items you no longer need to increase your savings rate.

- Research down payment assistance programs: Look into down payment assistance programs that may be available in your area. Some programs offer grants or loans to help first-time homebuyers with their down payment.

Saving for a down payment on a house can take time, but with a solid plan in place, it is achievable. By making saving a priority, reducing expenses, and looking for additional sources of income, you can build up your down payment savings and achieve your goal of owning a home.

4. Investing in stocks, bonds, or other types of securities.

Saving for a down payment on a house can seem like a daunting task, but with some careful planning and dedication, it is achievable. Here are some steps to help you save for a down payment on a house:

- Determine your down payment goal: The amount of money you need for a down payment will depend on the cost of the home and the down payment percentage required by your lender. As a general rule of thumb, aim to save at least 20% of the home’s purchase price for your down payment to avoid private mortgage insurance (PMI) charges.

- Create a budget: Create a budget to track your income and expenses. Look for areas where you can cut back on spending to increase your savings rate.

- Automate savings: Set up automatic transfers from your checking account to dedicated savings account each month. This way, you can build up your savings gradually without having to think about it.

- Consider a high-yield savings account: Look for a high-yield savings account that pays a higher interest rate than a traditional savings account. This can help your savings grow more quickly.

- Reduce debt: If you have high-interest debt, such as credit card balances or personal loans, focus on paying off this debt first. This will free up more money to put toward your down payment savings.

- Look for additional sources of income: Consider taking on a side job or selling items you no longer need to increase your savings rate.

- Research down payment assistance programs: Look into down payment assistance programs that may be available in your area. Some programs offer grants or loans to help first-time homebuyers with their down payment.

Saving for a down payment on a house can take time, but with a solid plan in place, it is achievable. By making saving a priority, reducing expenses, and looking for additional sources of income, you can build up your down payment savings and achieve your goal of owning a home.

5. Saving for retirement and setting a retirement income goal.

Setting a retirement income goal is an important step in planning for your financial future. Here are some steps to help you set a retirement income goal:

- Estimate your retirement expenses: Estimate your future retirement expenses based on your current lifestyle and expected changes in expenses in retirement. Consider expenses such as housing, food, healthcare, and travel.

- Determine your retirement age: Decide at what age you want to retire. This will help you determine the number of years you need to save for retirement and how much you need to save each year to reach your retirement income goal.

- Estimate your retirement income sources: Estimate your retirement income sources, including Social Security, pensions, and any other retirement savings you may have, such as a 401(k) or IRA.

- Determine your retirement income gap: Calculate the difference between your estimated retirement expenses and your expected retirement income. This will give you an idea of how much you need to save to reach your retirement income goal.

- Use retirement calculators: Use online retirement calculators to help you estimate your retirement income needs and determine how much you need to save to reach your retirement income goal.

- Adjust your savings plan: If you find that you are not on track to meet your retirement income goal, adjust your savings plan. Consider increasing your retirement contributions, working longer, or reducing your expenses in retirement.

Setting a retirement income goal is an important part of financial planning. By estimating your retirement expenses, determining your expected retirement income sources, and calculating your retirement income gap, you can create a plan to save and invest the amount you need to achieve your retirement income goal.

6. Starting a college fund for children or grandchildren.

Starting a college fund for your children is a smart financial decision that can help ensure they have the resources they need to pursue their educational goals. The cost of college tuition has been steadily rising, and it can be challenging for families to afford the expense. By starting a college fund early, you can save money over time and help your children avoid taking on large amounts of debt to pay for their education.

In addition to providing financial support for your children’s education, starting a college fund can also help teach them important lessons about money management and responsibility. By involving your children in the college savings process, you can teach them the value of saving, investing, and setting financial goals. This can help them develop good financial habits that will serve them well throughout their lives. Ultimately, starting a college fund for your children is an investment in their future that can have a significant impact on their success and financial well-being.

7. Creating a budget and sticking to it to manage expenses.

Creating a budget is an essential step in managing your finances effectively. A budget helps you track your income and expenses, prioritize your spending, and achieve your financial goals. Here are some steps to help you create a budget and stick to it:

- Track your income and expenses: Start by tracking your income and expenses for a month. Record every expense, including bills, groceries, transportation, and entertainment.

- Categorize your expenses: Categorize your expenses into fixed and variable expenses. Fixed expenses are those that do not change from month to month, such as rent or mortgage payments, car payments, and insurance premiums. Variable expenses are those that can fluctuate from month to month, such as food, entertainment, and travel.

- Prioritize your spending: Identify your essential expenses, such as housing, utilities, and transportation, and prioritize them in your budget. Then, allocate your remaining income to your discretionary expenses.

- Set financial goals: Set financial goals that align with your budget, such as paying off debt, saving for a down payment on a house, or building an emergency fund.

- Monitor your budget: Monitor your budget regularly and make adjustments as needed. Review your spending regularly and adjust your budget to stay on track.

- Use technology: Use budgeting tools and apps to help you track your spending and stay on budget.

- Stay motivated: Stay motivated by reminding yourself of your financial goals and the benefits of sticking to your budget.

Creating a budget and sticking to it can be challenging, but it is an important step in achieving your financial goals. By tracking your income and expenses, prioritizing your spending, and setting financial goals, you can take control of your finances and achieve financial stability.

8. Increasing income through a side hustle or additional job.

If you’re looking to increase your income, starting a side hustle can be a great way to earn extra money. A side hustle is a part-time job or business that you do in addition to your main source of income. It can be anything from freelance writing or graphic design to driving for a ride-sharing service or selling products online. The key is to find a side hustle that fits your skills and interests and that allows you to earn extra income on your own schedule.

Starting a side hustle can provide many benefits beyond just extra income. It can help you develop new skills, build a network of contacts, and explore new career paths. It can also provide a sense of fulfillment and accomplishment as you pursue your interests and passions. While it can be challenging to balance a side hustle with your other responsibilities, the potential rewards can be well worth the effort. By increasing your income with a side hustle, you can improve your financial situation, achieve your financial goals faster, and create a more stable and secure future for yourself and your family.

9. Paying off a mortgage early.

Paying off your mortgage early can provide many benefits, such as reducing your debt, saving money on interest, and increasing your financial stability. Here are some tips to help you pay off your mortgage early:

- Make extra payments: Making extra payments on your mortgage can help you pay it off faster. Consider making bi-weekly payments instead of monthly payments, or making an extra payment each year.

- Refinance your mortgage: Refinancing your mortgage can help you reduce your interest rate and shorten your loan term, which can save you thousands of dollars in interest over the life of your loan.

- Cut expenses: Cutting expenses can free up money to put toward your mortgage. Look for ways to reduce your monthly expenses, such as cutting cable TV, eating out less, or refinancing your car loan.

- Increase your income: Increasing your income through a side hustle or a part-time job can help you pay off your mortgage faster. Consider using the extra income to make extra payments on your mortgage.

- Consider a lump-sum payment: If you receive a windfall, such as an inheritance or a bonus, consider using it to make a lump-sum payment on your mortgage.

Paying off your mortgage early can provide many benefits, such as reducing your debt and saving money on interest. By making extra payments, refinancing your mortgage, cutting expenses, increasing your income, and making lump-sum payments, you can pay off your mortgage faster and achieve financial freedom.

10. Saving for a specific vacation or travel experience.

Saving for a vacation can be a fun and rewarding experience. Whether you’re planning a weekend getaway or a long-term trip, having a plan for saving can help make your vacation dreams a reality. Here are some tips to help you save for your next vacation:

- Set a budget: Start by setting a budget for your vacation. This will help you determine how much money you need to save and how long it will take to reach your goal. Be sure to include all expenses, such as airfare, accommodations, food, and activities.

- Create a savings plan: Once you have a budget, create a savings plan that works for you. Consider setting up a separate savings account for your vacation fund and automate your savings by setting up automatic transfers from your checking account to your savings account.

- Cut back on expenses: Look for ways to cut back on expenses to free up money for your vacation fund. Consider eating out less, cutting cable TV, or reducing your monthly subscription services.

- Use credit card rewards: Consider using credit card rewards to help pay for your vacation. Many credit cards offer cash back or travel rewards that you can use to offset the cost of your trip.

- Look for deals: Look for deals on airfare, accommodations, and activities to help save money on your vacation. Use travel websites and apps to compare prices and find the best deals.

By setting a budget, creating a savings plan, cutting back on expenses, using credit card rewards, and looking for deals, you can save for your next vacation and make your dream trip a reality.

11. Starting a business or investing in a startup.

Making investments can be a great way to grow your wealth and achieve your financial goals. Investing involves putting money into stocks, bonds, real estate, or other assets with the expectation of earning a return on your investment. Here are some tips to help you get started with investing:

- Determine your investment goals: Start by determining your investment goals, such as saving for retirement, buying a house, or funding your child’s education. Your investment goals will help you determine the types of investments that are best suited to your needs.

- Choose the right investment vehicles: There are many investment vehicles available, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each has its own risks and rewards, so it’s important to choose the right investments for your goals and risk tolerance.

- Diversify your portfolio: Diversifying your portfolio can help reduce your risk and increase your chances of earning a positive return. Consider investing in a mix of stocks, bonds, and other assets to spread your risk and maximize your returns.

- Monitor your investments: It’s important to monitor your investments regularly to ensure that they are performing as expected. Make adjustments to your portfolio as needed to keep it in line with your investment goals and risk tolerance.

By determining your investment goals, choosing the right investment vehicles, diversifying your portfolio, and monitoring your investments, you can make smart investment decisions that will help you achieve your financial goals.

12. Contributing regularly to a charitable cause or organization.

Contributing to charity is important for several reasons. First, it allows you to give back to your community and support causes that are important to you. By contributing to charity, you can help make a positive impact on the world and make a difference in the lives of others. Whether you donate money, time, or resources, your contribution can help support important causes and help those in need.

Second, contributing towards charity can also benefit you personally. Studies have shown that giving to charity can increase feelings of happiness, improve overall well-being, and reduce stress. Additionally, charitable contributions may also provide tax benefits, allowing you to deduct your donations from your taxable income.

Overall, contributing to charity is a meaningful way to support important causes and make a positive impact on the world. By giving back, you can improve your own well-being while also making a difference in the lives of others.

13. Saving for a major purchase, such as a car or home renovation.

Saving for a major purchase can be a challenging but rewarding process. Whether you’re saving for a new car, a home renovation, or a big-ticket item, having a plan in place can help you reach your goal. Here are some tips to help you save for a major purchase:

- Determine the cost: Start by determining the cost of the item you want to purchase. This will help you determine how much money you need to save and how long it will take to reach your goal.

- Set a budget: Once you know how much you need to save, create a budget that allows you to save money each month. Look for ways to cut back on expenses and redirect that money toward your savings goal.

- Automate your savings: Consider setting up automatic transfers from your checking account to a separate savings account for your major purchase. This will help you save consistently and make it easier to reach your goal.

- Look for opportunities to earn extra income: Look for ways to earn extra income, such as taking on a part-time job or selling items you no longer need. This can help you accelerate your savings and reach your goal faster.

- Stay motivated: Saving for a major purchase can take time and require discipline. Stay motivated by tracking your progress and celebrating milestones along the way.

By setting a budget, automating your savings, looking for opportunities to earn extra income, and staying motivated, you can save for a major purchase and achieve your financial goals.

14. Maximizing contributions to tax-advantaged retirement accounts.

Tax-advantaged retirement accounts are a popular way to save for retirement while also receiving tax benefits. These accounts allow you to save money on a tax-deferred or tax-free basis, which can help you save more money over time and reduce your tax liability.

There are several types of tax-advantaged retirement accounts, including traditional IRAs, Roth IRAs, 401(k)s, and 403(b)s. With a traditional IRA or 401(k), you can contribute pre-tax dollars to your account, which means you don’t have to pay taxes on the money until you withdraw it in retirement. With a Roth IRA or Roth 401(k), you contribute after-tax dollars, but your withdrawals in retirement are tax-free.

In addition to the tax benefits, tax-advantaged retirement accounts offer other advantages, such as the ability to contribute more money than you can with a regular savings account and the potential for higher returns over time. However, there are also limitations on how much you can contribute each year and when you can withdraw the money without penalties.

Overall, tax-advantaged retirement accounts can be a powerful tool for saving for retirement and reducing your tax liability. If you’re eligible, consider opening and contributing to a tax-advantaged retirement account to help secure your financial future.

15. Purchasing life insurance or other types of insurance to protect against financial risks.

Purchasing life insurance is an important step in protecting your loved ones in the event of your unexpected passing. Life insurance is a contract between you and an insurance company in which you pay regular premiums in exchange for a lump-sum payment, or death benefit, to your beneficiaries upon your death. This can help provide financial security to your loved ones and cover expenses such as funeral costs, outstanding debts, and living expenses.

When considering life insurance, it’s important to consider your needs and the needs of your loved ones. Factors such as your age, health, and financial obligations should be taken into account. You should also consider the amount of coverage you need and the type of policy that best suits your needs. There are two main types of life insurance: term life insurance and permanent life insurance.

Term life insurance provides coverage for a specified period of time, such as 10 or 20 years, and is typically less expensive than permanent life insurance. Permanent life insurance provides coverage for your entire life and includes a cash value component that can grow over time. This type of policy is typically more expensive, but can also offer additional benefits such as a source of tax-free retirement income.

Overall, purchasing life insurance can help provide financial security to your loved ones in the event of your passing. It’s important to carefully consider your options and work with a reputable insurance provider to ensure that you have the right coverage for your needs.

16. Establishing a trust or estate plan to protect and distribute assets.

Establishing an estate plan is an important step in protecting your assets and ensuring that your wishes are carried out after your passing. An estate plan typically includes a will, which outlines how your assets will be distributed, as well as other important documents such as a power of attorney, healthcare directive, and trusts.

One of the main benefits of establishing an estate plan is that it allows you to have control over how your assets are distributed and who will manage your affairs in the event of your incapacitation or death. Without a proper estate plan, your assets may be subject to probate, which can be a time-consuming and expensive process that can also leave your loved ones with less than you intended.

Another benefit of an estate plan is that it can help minimize taxes and other expenses associated with settling an estate. By establishing trusts and other tax-efficient strategies, you can help ensure that your loved ones receive the maximum benefit from your assets.

Establishing an estate plan can also provide peace of mind, knowing that your affairs are in order and your loved ones will be taken care of in the event of your passing. It’s important to work with an experienced attorney or financial advisor to ensure that your estate plan is tailored to your unique needs and goals. Regular review and updates to your estate plan can also help ensure that it remains relevant and up-to-date.

17. Building a diverse investment portfolio with a mix of stocks, bonds, and other assets.

Building a diverse investment portfolio is an important strategy for managing risk and maximizing returns. A diverse investment portfolio is one that includes a mix of different asset classes, such as stocks, bonds, real estate, and alternative investments. By investing in a variety of assets, you can help reduce the impact of market volatility and protect your investments against unexpected events.

One of the main benefits of a diverse investment portfolio is that it can help maximize returns while minimizing risk. Different asset classes tend to perform differently under different market conditions, so by investing in a mix of assets, you can potentially benefit from market upswings while also protecting your investments during downturns.

Another benefit of a diverse investment portfolio is that it can help you achieve your financial goals. By investing in a mix of assets, you can tailor your portfolio to your specific needs and goals, whether you’re looking for long-term growth, regular income, or capital preservation.

When building a diverse investment portfolio, it’s important to consider your risk tolerance, investment goals, and time horizon. You should also diversify within each asset class by investing in a mix of individual securities, mutual funds, and exchange-traded funds (ETFs). Regular review and rebalancing of your portfolio can also help ensure that it remains aligned with your goals and risk tolerance.

Overall, building a diverse investment portfolio can help you manage risk, maximize returns, and achieve your financial goals over the long term. By working with an experienced financial advisor and regularly monitoring your portfolio, you can help ensure that your investments remain on track to meet your goals.

18. Paying off student loans or other educational debt.

Paying off student loans is an important step in achieving financial freedom and stability. Student loan debt can be a significant burden, impacting your ability to save for other goals and limiting your options for financial flexibility. By paying off your student loans, you can reduce your monthly expenses and free up more money for other priorities.

One of the main benefits of paying off student loans is that it can help improve your credit score. Student loan debt is considered a type of installment debt, which is factored into your credit score along with other factors such as payment history, credit utilization, and length of credit history. By making regular, on-time payments and ultimately paying off your student loans, you can demonstrate responsible credit behavior and potentially improve your credit score.

Another benefit of paying off student loans is that it can help you save money over the long term. Student loans typically come with interest charges, which can add up over time and increase the overall cost of your loan. By paying off your loans early or making extra payments, you can reduce the amount of interest you pay and potentially save thousands of dollars over the life of your loan.

When paying off student loans, it’s important to have a plan in place that fits your budget and goals. This may include making extra payments, refinancing to a lower interest rate, or exploring loan forgiveness programs if you qualify. By staying disciplined and focused on your goals, you can successfully pay off your student loans and achieve greater financial stability.

19. Developing a financial plan with a financial advisor.

Developing a financial plan with a financial advisor can help you clarify your financial goals and create a roadmap for achieving them. Here are some steps you can take to develop a financial plan with a financial advisor:

- Identify your financial goals: Before meeting with a financial advisor, take some time to think about your financial goals. Do you want to save for retirement, pay off debt, purchase a home, or start a business? Clarifying your goals will help your financial advisor tailor your plan to your specific needs.

- Gather your financial information: To develop a comprehensive financial plan, your advisor will need to know about your current financial situation. This includes your income, expenses, assets, liabilities, and investment portfolio. Gather all relevant financial documents and be prepared to share this information with your advisor.

- Schedule an initial consultation: Contact a financial advisor to schedule an initial consultation. This is an opportunity to get to know each other and determine whether the advisor is a good fit for your needs.

- Develop a financial plan: After the initial consultation, your financial advisor will work with you to develop a comprehensive financial plan. This may include recommendations for investing, saving, budgeting, and managing debt. The plan should be tailored to your specific goals and financial situation.

- Implement the plan: Once the financial plan is developed, it’s important to put it into action. Your financial advisor can help you implement the plan and provide ongoing support and guidance as you work towards your goals.

- Review and adjust the plan: Your financial plan should be reviewed and adjusted periodically to ensure that it remains aligned with your goals and financial situation. Work with your financial advisor to make any necessary adjustments and stay on track toward achieving your financial goals.

Overall, developing a financial plan with a financial advisor can provide valuable guidance and support as you work towards achieving your financial goals. By following these steps, you can create a plan that is tailored to your specific needs and helps you achieve financial stability and success.

20. Setting a goal to achieve financial independence or early retirement.

Achieving financial independence for early retirement requires careful planning and a long-term commitment to saving and investing. Here are some steps you can take to work towards financial independence and early retirement:

- Determine your financial goals: To achieve financial independence and early retirement, you need to know how much money you will need to support your lifestyle. Calculate your expected expenses and set a target for how much money you will need to accumulate.

- Maximize your savings: To accumulate the necessary funds for early retirement, you need to save aggressively. Maximize your contributions to tax-advantaged retirement accounts, such as 401(k)s and IRAs, and consider additional savings vehicles such as a Health Savings Account (HSA) or a taxable investment account.

- Invest for growth: To grow your savings, you need to invest in a diversified portfolio of assets that can generate long-term growth. Consider investing in a mix of stocks, bonds, and other asset classes that align with your risk tolerance and investment goals.

- Minimize your expenses: To maximize your savings, you need to minimize your expenses. Review your budget and identify areas where you can cut back on spending, such as eating out less often, reducing housing expenses, or buying used instead of new.

- Consider additional income streams: To accelerate your savings, consider generating additional income streams, such as through a side hustle or freelance work. This can help you save more money and achieve financial independence more quickly.

- Review and adjust your plan: As you work towards financial independence and early retirement, it’s important to regularly review and adjust your plan as needed. Factors such as changes in your income, expenses, or investment returns can impact your progress toward your goals.

Overall, achieving financial independence for early retirement requires a long-term commitment to saving and investing, along with careful planning and disciplined spending habits. By following these steps, you can work towards achieving your goal of early retirement and financial independence.

Conclusion…

Even if you are not in your twenties it is never too late to start setting reasonable financial goals that can give you the financial freedom you desire. When you see a goal is not serving you as it should. Take time to evaluate and take a new direction.