This post may contain affiliate links.We may earn little commission or products from the companies mentioned in this post.

You need to be able to identify unnecessary expenses and find ways to cut them down. Today you are in luck as we will be looking at what those expenses are, how to identify them, and most importantly how to ensure they are not eating up your finances.

What unnecessary expenses are:

These expenses are mostly wants and you can live well without them. They are not your basic needs, neither are they secondary needs, hence you can put them on hold or completely kiss them goodbye. However, these unnecessary expenses often present themselves as necessary which makes it difficult to cut them down. It is a good thing we will be identifying them first.

Why you need to identify unnecessary expenses

You need to identify unnecessary expenses so you can manage your money properly. It makes it easier to be able to live according to your means once you know these expenses because the next step is cutting them down.

9 Ways to Identify Unnecessary Expenses

1. Track Your Spending

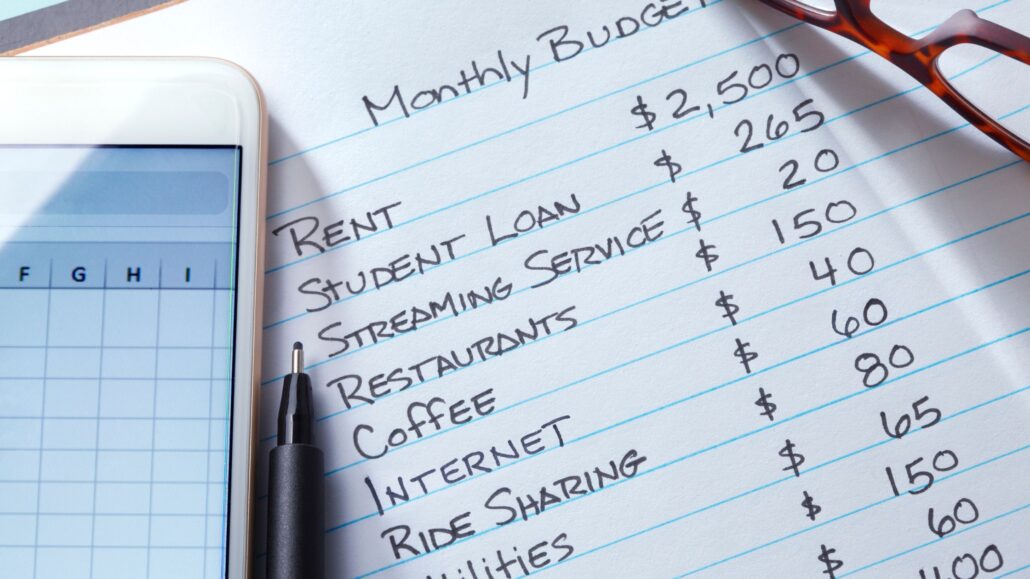

- Keep a Detailed Record: Use apps, spreadsheets, or even a notebook to track expenses.

- Categorize Expenses: Divide expenses into categories such as groceries, entertainment, dining out, utilities, etc.

2. Review Your Spending

- Analyze Monthly Statements: Review bank and credit card statements to identify patterns.

- Look for Recurring Expenses: Identify subscriptions and memberships that you may not use or need anymore.

3. Differentiate Between Needs and Wants

- Needs: Essential expenses such as rent, utilities, groceries, and transportation.

- Wants: Non-essential expenses like dining out, entertainment, and luxury items.

- Question Each Purchase: Ask yourself if each expense is a necessity or a luxury.

4. Set Financial Goals

- Short-term and Long-term Goals: Define what you are saving for, such as an emergency fund, a vacation, or retirement.

- Prioritize Spending: Align your spending with your financial goals.

5. Create a Budget

- Allocate Funds Wisely: Ensure that essential expenses are covered first.

- Set Limits: Allocate a specific amount for non-essential categories and stick to it.

6. Identify Overlaps and Redundancies

- Consolidate Services: Combine multiple services into one if possible, such as phone and internet packages.

- Eliminate Redundancies: Cancel duplicate or overlapping services.

7. Evaluate Cost-Effective Alternatives

- Shop Smart: Look for discounts, use coupons, and compare prices.

- DIY When Possible: Consider doing things yourself instead of paying for services, such as home repairs or cooking at home.

8. Reduce Impulse Buying

- Wait Before Purchasing: Implement a waiting period for non-essential purchases to avoid impulsive decisions.

- Create a Shopping List: Stick to a pre-planned list when shopping.

9. Monitor and Adjust Regularly

- Regular Check-Ins: Review your budget and spending habits monthly.

- Adjust as Needed: Make changes based on your financial situation and goals.

Tools and Apps for Expense Tracking

- Expense Tracking Apps: Mint, YNAB (You Need A Budget), PocketGuard, and Personal Capital.

- Banking Apps: Many banks offer expense-tracking features within their apps.

Example of Expense Tracking Sheet

| Date | Description | Category | Amount | Need/Want |

|---|---|---|---|---|

| 2024-05-01 | Grocery Store | Groceries | $150 | Need |

| 2024-05-02 | Netflix | Entertainment | $15 | Want |

| 2024-05-03 | Electric Bill | Utilities | $60 | Need |

| 2024-05-04 | Coffee Shop | Dining Out | $5 | Want |

By systematically analyzing and categorizing your expenses, you can identify which ones are unnecessary and take steps to eliminate or reduce them.

How to cut them down

1. The Subscription Challenge

- Pause All Subscriptions: Temporarily pause all your subscriptions for a month.

- Assess Impact: Determine which ones you truly miss or need.

- Cancel Unused Subscriptions: Cancel those you didn’t miss or use.

2. The Cash-Only Experiment

- Switch to Cash: For a month, use only cash for discretionary spending.

- Visualize Spending: Physically seeing money leave your wallet can make you more aware of your spending habits.

- Track the Difference: Compare your spending to previous months to identify unnecessary expenses.

3. Reverse Budgeting

- Start with Savings Goals: Allocate a portion of your income to savings and investments first.

- Live on the Rest: Use the remaining amount for all expenses, forcing you to prioritize necessary expenses.

- Identify Unnecessary Items: What you can’t afford with the remaining amount likely includes unnecessary expenses.

4. The 30-Day Rule

- Wait 30 Days: Before making any non-essential purchase, wait 30 days.

- Reassess the Need: Often, the initial urge to buy fades, helping you avoid impulse buys.

5. Expense Diary

- Daily Log: Keep a daily log of every expense, noting why you made the purchase and how it made you feel.

- Identify Patterns: Look for emotional triggers or habits that lead to unnecessary spending.

6. Minimalist Challenge

- Declutter: Go through your belongings and remove items you don’t use or need.

- Avoid Duplication: Take note of things you have in excess and avoid buying similar items in the future.

- Simplicity Mindset: Adopt a minimalist mindset, prioritizing quality over quantity.

7. Friends and Family Audit

- Outside Perspective: Ask trusted friends or family members to review your spending.

- Identify Blind Spots: They might spot unnecessary expenses you overlook or provide advice on cutting costs.

8. Monthly Theme Experiment

- Single Category Focus: Each month, focus on reducing expenses in a single category (e.g., dining out, entertainment).

- Creative Alternatives: Find low-cost or free alternatives for entertainment or dining.

9. Utility Usage Analysis

- Monitor Utility Bills: Use tools to monitor and analyze your utility usage (e.g., smart meters).

- Identify Waste: Spot patterns of wasteful usage and make adjustments to reduce costs.

10. Receipts Review

- Collect Receipts: Save all receipts for a month and review them at the end.

- Evaluate Each Purchase: Assess the necessity and value of each purchase, identifying which ones you could have done without.

11. Seasonal Spending Review

- Analyze Seasonal Expenses: Look at your spending over different seasons or holidays.

- Plan Ahead: Budget for these periods and identify ways to cut back on non-essential seasonal spending.

12. Debt Detox

- Interest Rate Focus: Prioritize paying off high-interest debt, which can be a significant unnecessary expense over time.

- Debt Snowball/Avalanche: Use strategies like the debt snowball or avalanche methods to reduce debt efficiently.

Conclusion

By incorporating these unique methods into your financial review process, you can gain deeper insights into your spending habits and more effectively identify and eliminate unnecessary expenses.