This post may contain affiliate links.We may earn little commission or products from the companies mentioned in this post.

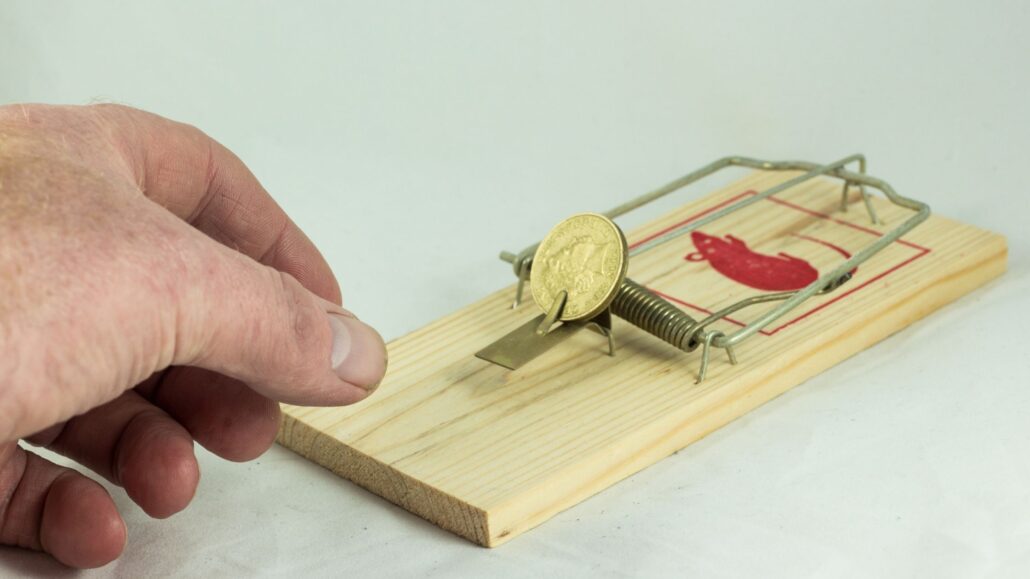

Debt traps are situations or schemes that make it very difficult for individuals to escape a cycle of debt. While some debt traps like payday loans and credit card debt are well-known, there are several rare or less commonly discussed debt traps that people should be aware of. Hence, here is a list of debt traps you didn’t know and how to avoid them.

10 debt traps you didn’t know

Balloon Payments:

Description: Loans structured with low initial payments but a large lump-sum payment at the end.

Why It’s a Trap: Borrowers may struggle to save enough for the final payment, leading to refinancing at unfavorable terms.

Negative Amortization Loans:

Description: Loans where payments are less than the interest due, causing the loan balance to increase over time.

Why It’s a Trap: Borrowers end up owing more than they initially borrowed, increasing their debt burden.

Tax Lien Sales:

Description: Local governments sell unpaid property tax bills to investors who then charge high interest and fees.

Why It’s a Trap: Homeowners can lose their property if they can’t repay the debt plus interest and fees.

Structured Settlements:

Description: Receiving lawsuit settlements as a stream of payments rather than a lump sum.

Why It’s a Trap: Selling these payments for immediate cash results in significant losses compared to the original settlement value.

Pension Loans:

Description: Loans offered against future pension payments.

Why It’s a Trap: High interest rates and fees can drastically reduce future retirement income.

Subscription Services:

Description: Recurring subscription services that are easy to sign up for but difficult to cancel.

Why It’s a Trap: Small recurring fees accumulate, leading to substantial financial drain over time.

Rent-to-Own Agreements:

Description: Agreements to rent items with the option to buy at the end of the rental period.

Why It’s a Trap: High total cost compared to purchasing upfront, often resulting in payments far exceeding the item’s value.

Cosigning Loans:

Description: Agreeing to be responsible for someone else’s loan if they default.

Why It’s a Trap: Cosigners are liable for the full debt if the primary borrower defaults, which can damage their credit and financial standing.

Interest-Only Mortgages:

Description: Mortgages where payments only cover the interest for a certain period.

Why It’s a Trap: After the interest-only period, payments increase significantly, potentially leading to unaffordability and default.

Reverse Mortgages for Young Seniors:

Description: Seniors taking out reverse mortgages too early.

Why It’s a Trap: They may outlive the benefits, leaving them with no home equity and insufficient funds later in life.

Foreign Currency Loans:

Description: Loans taken in foreign currencies to benefit from lower interest rates.

Why It’s a Trap: Currency fluctuations can drastically increase the amount owed in the borrower’s local currency.

Retail Financing Offers:

Description: Store credit and financing deals that seem attractive but come with hidden fees and high interest rates.

Why It’s a Trap: Deferred interest and penalties for late payments can lead to much higher costs than anticipated.

Awareness of these less common debt traps can help individuals make more informed financial decisions and avoid potentially devastating financial consequences.

How to avoid these debt traps

Let’s see very simple ways to avoid these debt traps now that you know them